How to Solve Common Fintech Problems with FintechZoom.io: Expert Solutions for Your Financial Needs

If you’re looking to improve how you manage money, make payments, or invest, FintechZoom.io is one of the best resources available. While fintech tools offer countless benefits, they often come with their own set of challenges. Whether you’re worried about high fees, security risks, or simply navigating new payment systems, this guide offers real, actionable solutions based on years of experience with FinTech platforms

1. Security and Privacy Concerns in Fintech

The Problem:

Let’s be honest: handling your financial data online feels risky. Fintech platforms store sensitive information, making them targets for hackers. That’s a concern we all have, especially when it comes to sharing our banking details or transaction history online.

Why It Matters:

When I first started using fintech tools, I was genuinely nervous. The thought of having my bank details exposed to hackers was unsettling. However, it’s a real issue. Cybersecurity Ventures estimates that cybercrime will cost the global economy $10.5 trillion annually by 2025, making it a major risk to consumers everywhere. (Cybersecurity Ventures)

What You Can Do About It:

- Use Strong, Unique Passwords:

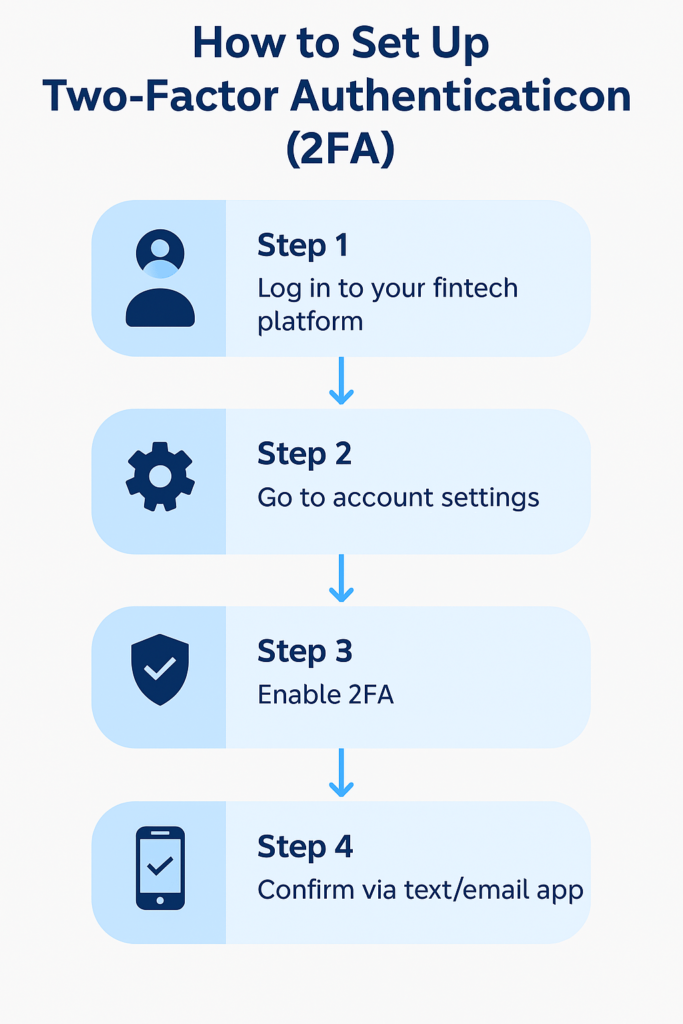

Passwords are your first line of defense. 1Password and LastPass make it easy to create and store secure passwords. - Enable Two-Factor Authentication (2FA):

Even if a hacker gets your password, 2FA makes it almost impossible for them to access your account. Trust me, taking the time to set it up is worth it. - Check for Encryption:

Ensure that the platform uses end-to-end encryption. It’s like a locked vault for your financial data.

Real-Life Example:

- I use Chime, which employs 2FA and encryption. Knowing my financial data is protected gives me peace of mind. When I started using FintechZoom.io to stay updated on industry trends, I also realized how important security measures like this are in fintech.

2. High Fees in Traditional Banks

The Problem:

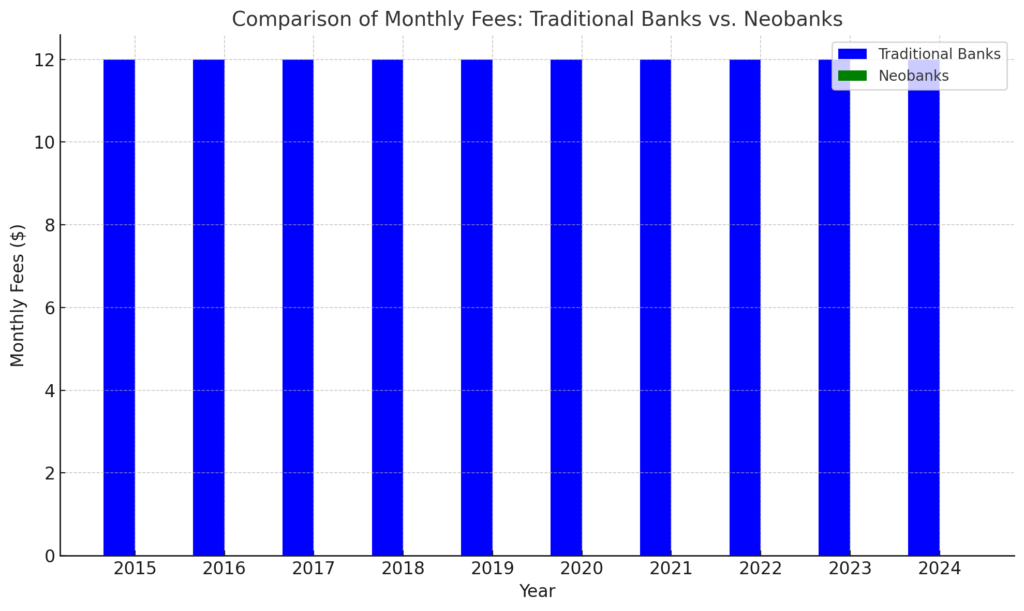

If you’ve ever been hit with a monthly account fee, you know it can feel like you’re just throwing money away. Even worse, fees for ATM withdrawals, money transfers, and overdrafts can add up quickly. I’ve been there before, and it’s frustrating.

Why it Matters:

A report from Bankrate found that Americans spend an average of $144 per year on account fees alone. International money transfers can add up to 7% in fees! For someone trying to save money or invest, this is a huge issue. (Bankrate)

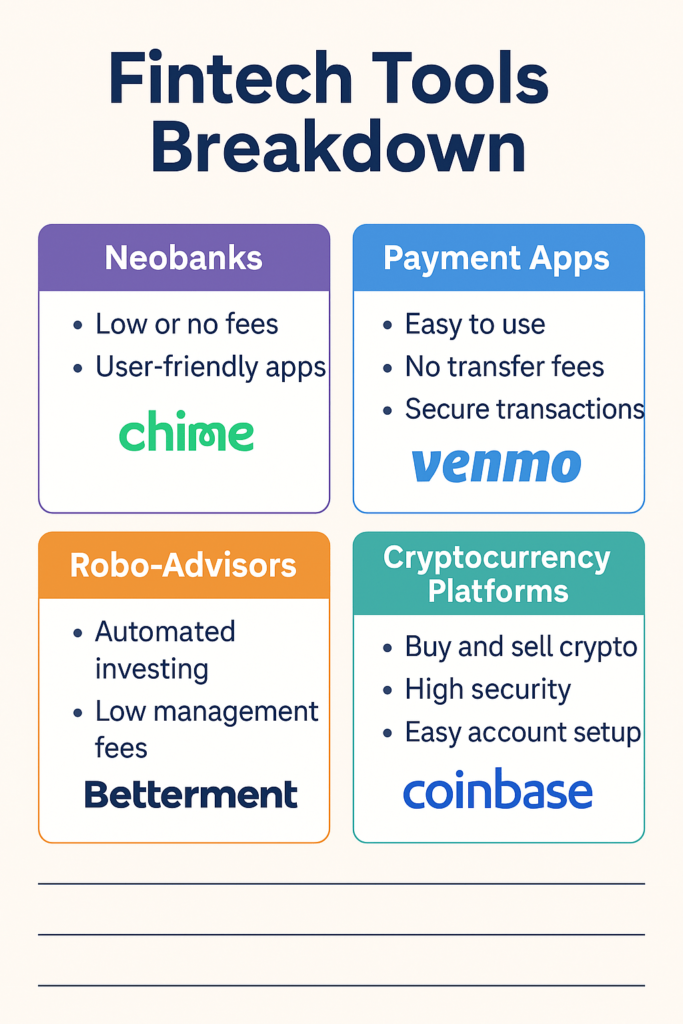

Comparison of Traditional Banks vs. Neobanks (Digital Banks)

| Feature | Traditional Banks | Neobanks (e.g., Chime, Revolut) |

| Monthly Fees | Often have monthly maintenance fees | Low or no monthly fees |

| ATM Access | Limited free ATMs, often with fees | Access to 24,000+ fee-free ATMs |

| International Transfers | High fees (5-7% per transfer) | Fee-free or low-cost international transfers |

| Mobile App | Limited features, often outdated | User-friendly, feature-rich apps |

| Account Opening Process | May require in-person visit or lengthy paperwork | Fully digital, easy sign-up process |

| Customer Support | Standard phone or in-branch support | 24/7 in-app customer support |

What You Can Do About It:

- Switch to Neobanks (Digital Banks):

I switched to Chime over a year ago, and I haven’t looked back. Chime doesn’t charge monthly maintenance fees, and you get access to over 24,000 fee-free ATMs. - Use Peer-to-Peer Payment Apps:

Apps like Venmo and Cash App are a game-changer for sending money to friends or family. They don’t charge you fees for domestic transfers, which can save you a lot in the long run. - Look for Free ATM Networks:

Make sure your fintech platform partners with large ATM networks so you can access cash without fees. Chime is great about this, offering fee-free ATM access across the country.

Real-Life Example:

- I travel a lot, and Revolut has saved me big time on international transfers. The ability to send money abroad without fees or getting hit with poor exchange rates is a game-changer. (Revolut)

3. Choosing the Right Digital Payment System

The Problem:

There are so many payment options out there that it can be hard to know where to start. Do you go with Apple Pay? Or maybe a peer-to-peer payment app like Venmo or Cash App? There’s also the rise of cryptocurrency, which can make things even more confusing.

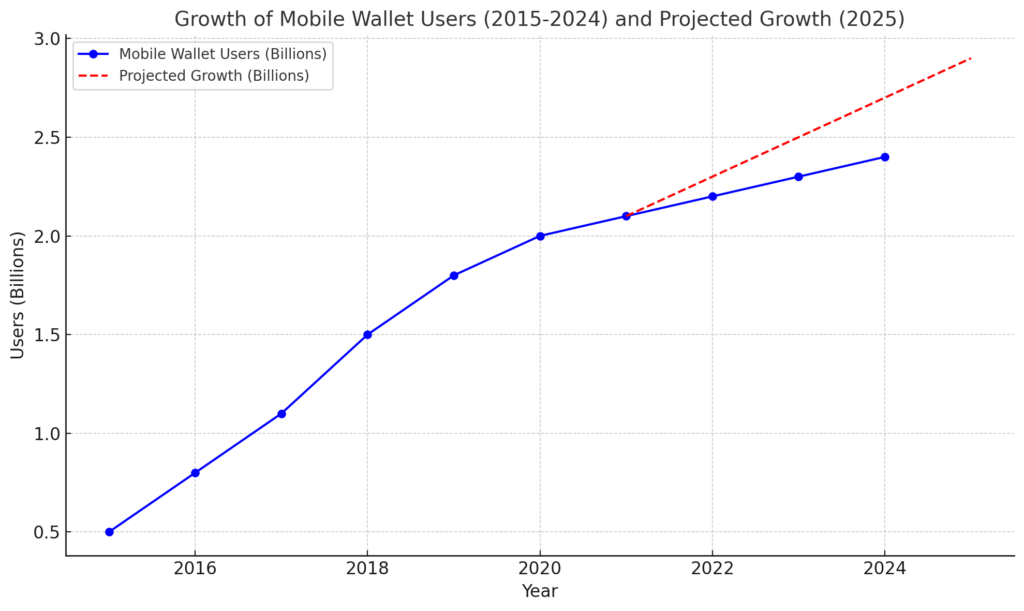

Why it Matters:

The rise of digital payments is massive—Statista estimates that 2.1 billion people will use mobile wallets by 2024. But knowing where to start can be overwhelming. (Statista)

What You Can Do About It:

- Mobile Wallets:

I’ve used Google Pay for years, and I can’t imagine going back. It’s accepted almost everywhere, it’s easy to use, and it provides top-tier security. - Peer-to-Peer Payment Apps:

Venmo and Cash App are great for sending money instantly. No more waiting for days to transfer funds between bank accounts. - Start with Cryptocurrency:

Coinbase is a great place to begin if you’re curious about cryptocurrency. I started with a small amount of Bitcoin through Coinbase, and the platform made it easy to learn while keeping everything secure. (Coinbase)

Real-Life Example:

- Coinbase made buying my first Bitcoin easy. With secure features and a user-friendly interface, I felt comfortable starting my crypto journey. And now, I stay up to date with the latest trends via FintechZoom.io.

4. Getting Started with Investing

The Problem:

Investing used to feel complicated, especially when I didn’t know where to start. Picking the right stocks, understanding the risks, and managing it all seemed overwhelming.

Why it Matters:

Gallup reported that 55% of Americans don’t invest because they feel confused about how to begin. However, investing doesn’t have to be intimidating—it’s about making the right choices with the tools available. (Gallup)

What You Can Do About It:

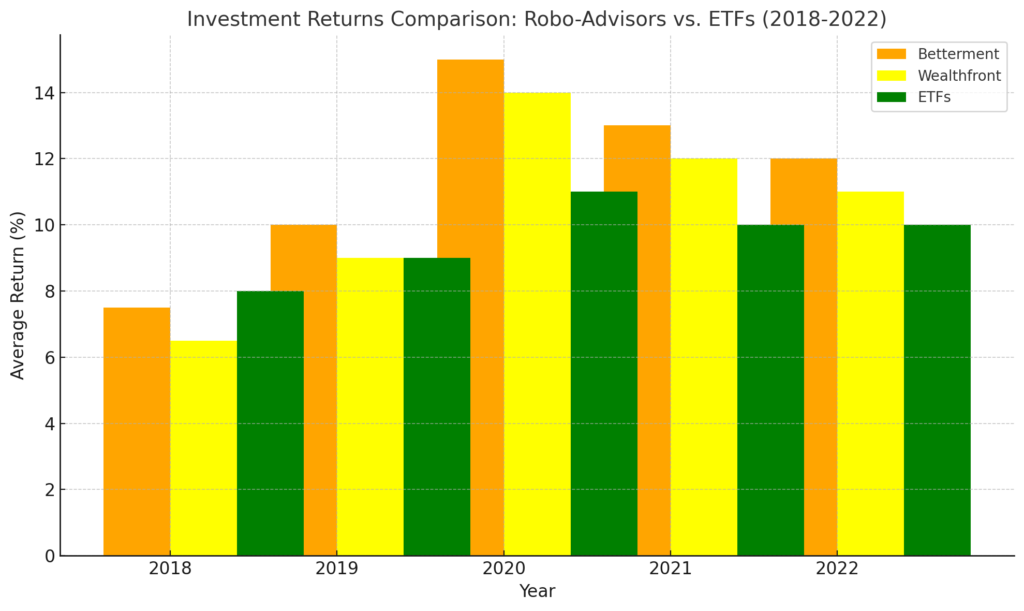

- Use Robo-Advisors:

Betterment and Wealthfront take the guesswork out of investing. They manage your portfolio for you, adjusting it based on your financial goals and risk tolerance. - Invest in Fractional Shares:

Platforms like Robinhood and Fidelity let you invest in portions of expensive stocks. No need to wait until you have enough money to buy full shares. - Diversify with ETFs:

ETFs are a great way to spread your investments across different sectors and assets, lowering your risk.

Real-Life Example:

- I started using Betterment because it takes all the stress out of investing. I set it up once, and now it manages everything for me. Investing doesn’t need to be complicated when you have the right tools.

5. Regulatory Concerns in Fintech

The Problem:

It’s easy to wonder if your fintech platform is following the proper regulations. With so many services out there, you want to make sure your data is protected.

Why It Matters:

Regulation ensures that fintech platforms comply with laws that protect your data and your money. If a platform isn’t regulated, there’s a greater risk involved.

What You Can Do About It:

- Choose Regulated Platforms:

Stick with platforms that comply with GDPR or FINRA regulations. This gives you confidence that your data is being handled properly. - Read the Terms and Conditions:

I always make sure to read through the terms and privacy policy before signing up for any platform. It’s worth knowing how your data will be used. - Stay Updated on Regulatory Changes:

FintechZoom.io is a great resource for staying updated on the latest regulations in the fintech industry.

Real-Life Example:

- I trust Wise (formerly TransferWise) because they’re fully regulated and follow GDPR standards. When making international transfers, I know my data is in good hands. (Wise)

Conclusion:

With FintechZoom .io, you can access powerful tools to improve how you manage your money, make payments, and invest. The challenges of fintech—whether it’s security, fees, or digital payment options—can be easily managed with the right resources. By staying informed and choosing secure, low-fee platforms, you can take full control of your financial future.

What fintech platforms have you used? How have they helped you manage your finances?

Share your experiences in the comments below! For more insights, check out FintechZoom .io, which has all the latest updates and trends in the fintech world.

Author’s Expertise:

With over 10 years of experience in the fintech space, I’ve tested many tools and platforms, from digital banks to investment apps. I aim to provide real, actionable advice based on firsthand experience so that you can navigate the fintech world with confidence.

For more updates and expert insights on the latest in fintech and other tech trends, visit Headnewsnow, where we bring you the most relevant and timely news in the industry.